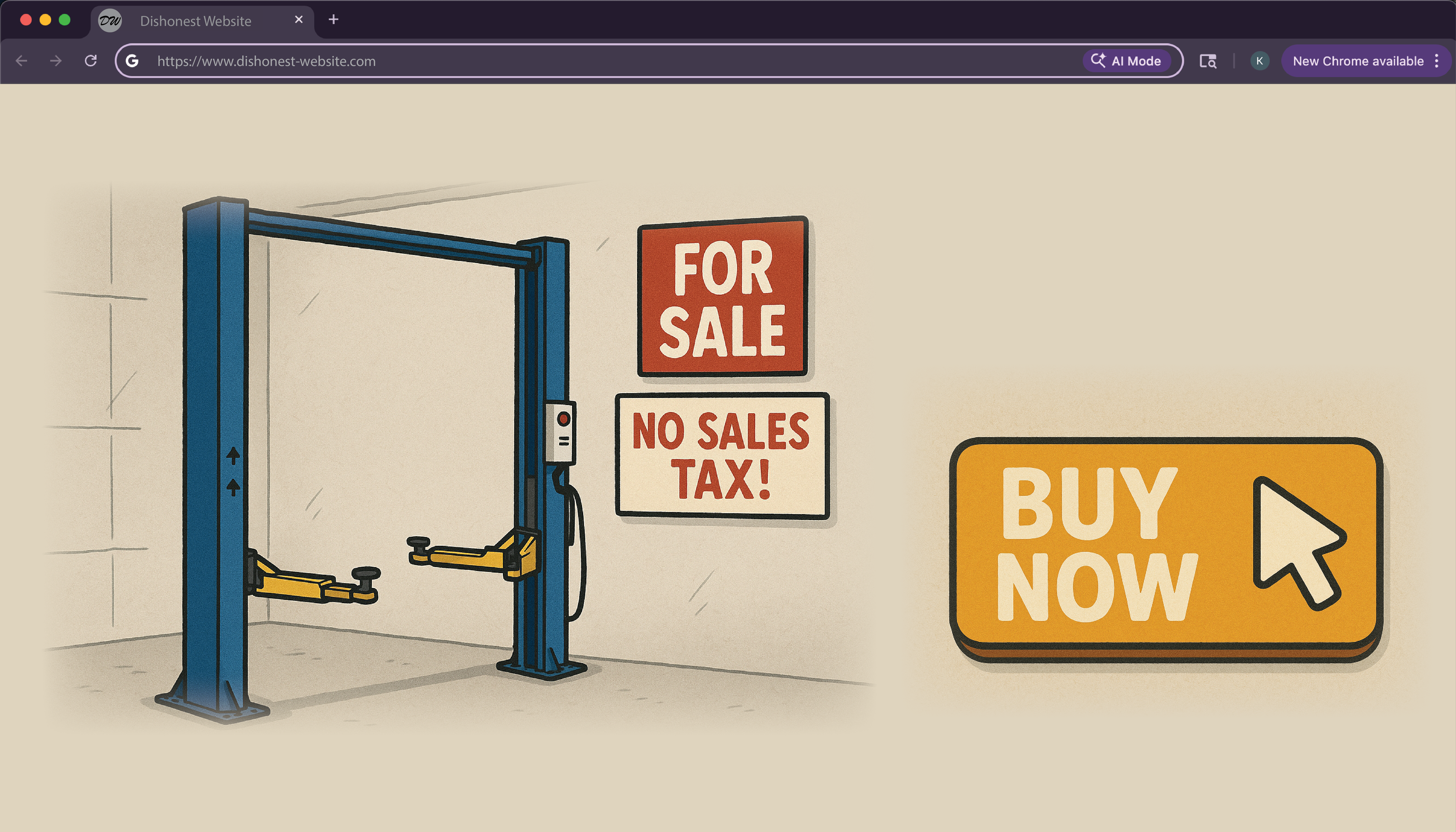

Before You Buy: Beware 'No Sales Tax' on Online Purchases

Before You Buy: Beware 'No Sales Tax' on Online Purchases

We want you to feel confident about price and compliance—wherever you shop. Here are a few quick points to help you avoid surprises later.

- “No sales tax” at checkout doesn’t mean tax-free. In many states, if a seller doesn’t collect sales tax, the buyer is responsible for paying use tax when filing state taxes.

- Many sellers must collect tax based on “economic nexus.” Once certain sales thresholds are met in a state, collection is required. Buying from sellers who fail to collect required taxes is risky, as backtaxes can bankrupt such companies and leave you without money and equipment.

- Transparent checkout protects you. Clear tax shown at checkout and an itemized receipt make record-keeping simple.

How We Handle Tax

- We collect and remit sales tax where required by law.

- We show estimated tax in cart/checkout for transparency.

- We provide itemized receipts for your records.

Quick Checklist for Shoppers

- Is tax shown at checkout?

- Will I receive an itemized receipt?

- If no tax is collected, do I need to self-report use tax?

- Does the seller state where they collect/remit tax?

Do I owe tax if a store doesn’t collect it?

Likely. Many states require buyers to report and pay use tax on untaxed purchases when filing their state taxes. Check your state’s guidance or ask a tax professional.

What is economic nexus?

It’s a rule that requires sellers to collect sales tax in a state once they exceed certain sales or transaction thresholds there.

Why does transparency matter?

Seeing taxes at checkout and getting itemized receipts helps you budget accurately and avoid unexpected bills later.

Disclaimer: This page is for educational purposes only and is not legal or tax advice. For guidance specific to your situation, please consult your tax advisor or your state’s Department of Revenue.

US Dollars

US Dollars