CALL US TOLL FREE | 9am-6pm EST | M-F

LOCATIONS ACROSS THE NATION | TO SERVE THE ENTIRE COUNTRY

Leading Automotive Equipment Dealer Since 1987

CALL US TOLL FREE | 9am-6pm EST | M-F

LOCATIONS ACROSS THE NATION | TO SERVE THE ENTIRE COUNTRY

Leading Automotive Equipment Dealer Since 1987

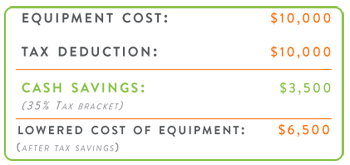

Save Huge Savings by Utilizing the Section 179 Tax Deduction can make a HUGE difference to your bottom line come tax season. If you are looking to buy or finance equipment before the year's end, then you are able to capitalize on Section 179.

Save Huge Savings by Utilizing the Section 179 Tax Deduction can make a HUGE difference to your bottom line come tax season. If you are looking to buy or finance equipment before the year's end, then you are able to capitalize on Section 179.

If you have not yet heard of Section 179, you maybe missing out on a substantial tax incentive. Section 179 allows businesses to write off full equipment costs in the year they buy it rather than capitalizing costs over the useful life of the equipment and waiting years to receive deductions.

For more information on Section 179 Click Here.

Business Financing Benefits

Build Your Business

Build Your Business

Establishing and managing business credit can help your company secure financing when you need it and with better terms.

100 % Tax Deductible

100 % Tax Deductible

Section 179 of the IRS Tax Code allows your business to deduct the full purchase price of your equipment. Consult your tax professional for the full details on this benefit.

Preserve Cash

Preserve Cash

Keep your cash available for emergencies and other unexpected circumstances such as payroll, inventory, etc.

Finance Questions?

Finance Questions?

Chad Schaffner

(480) 622-1170

[email protected]